How to Weatherize for Winter

Save Money and Live Comfortably When Temperatures Drop

New Yorkers are no stranger to layering up when temperatures dip below freezing. Preparing for winter applies to homes and businesses, too, by way of weatherization.

Weatherization (sometimes called weatherproofing) involves protecting a building’s interior from outside temperatures and moisture. In winter, weatherization upgrades like air sealing and insulation improve heat retention, cut energy use, enhance indoor comfort, and prevent ice dams and damage to the building.

Get the full scoop on weatherization, including its benefits, best practices, and available programs and incentives, in this comprehensive guide.

Why is Weatherization Important?

Along with frigid temperatures and shorter days, winter in New York brings increased demand for heating homes and businesses. In a typical home, 43% of annual energy consumption goes toward space heating[1]. But if the building envelope isn’t weatherized, air leaks will drive down efficiency come wintertime, wasting about 25-40% of energy used for heating[2].

Air leakage isn’t just about wasting money and energy – it can impede comfort by creating drafts and uneven temperatures throughout a home or building. Inefficient, leaky buildings can also pose health and safety risks due to thermal stress, poor ventilation, and exposure to mold and allergens.

Weatherization mitigates these issues by shielding a building from the elements – keeping heat inside and preventing moisture and pollutants from creeping in for improved comfort, health, and efficiency.

It’s also a fundamental step before making other efficiency upgrades. By reducing the energy needed for space heating and cooling, a well-insulated, weatherized building could be sized for a smaller, lower cost heat pump system ![]() .

.

How to Weatherize Your Home or Business

Between the building envelope and heating and cooling systems, there are a variety of improvements that can contribute to weatherization depending on a building’s needs. Many of these cost-saving investments are eligible for Inflation Reduction Act (IRA) tax credits or covered through New York State programs (more on that below).

In any case, weatherization begins with an energy assessment to pinpoint exactly where a building is leaking air, thus wasting energy for heating and cooling. New York homeowners and renters living in 1-4 family homes can get a no-cost home energy assessment with a certified energy auditor. Technical assistance and incentives are also available for commercial and multifamily buildings to complete an energy assessment.

Here's a look at some of the most common and cost-effective weatherization upgrades.

1. Address Air Leaks

Air leakage through cracks and gaps in the walls, floors, and roof can hinder heating efficiency and comfort. Though leaks around windows or floorboards can be easy to detect, other infiltration points such as the attic, recessed lighting, and foundation are less obvious, underscoring the importance of a professional energy assessment.

There are multiple options for air sealing, including weatherstripping, caulking, and spray foams. Caulking windows or weatherstripping doors are feasible DIY projects to take care of drafts and start recouping energy savings. Working with a qualified contractor is recommended for sealing air leaks in the attic, rim joists, and other hard-to-reach places.

2. Add Insulation

Installing insulation creates a stronger thermal barrier between the interior and exterior of the home or building, improving efficiency and temperature control. Insulation also limits outside noise and protects against pests.

Many older homes and buildings in New York are uninsulated or insufficiently insulated. The attic (both the floor and roof), basement, crawl spaces, and exterior walls are the primary locations for adding or replacing insulation with weatherization in mind.

There are multiple insulation materials to choose from, but all are measured in terms of their R-value, with higher R-values indicating greater thermal resistance.

Homeowners can expect to save around 15% on heating and cooling from adding insulation and air sealing[3].

3. Upgrade Windows and Doors

Caulking windows and weatherstripping doors can cut down on air leaks, but further repair or replacement may be necessary depending on their condition.

Homes and buildings with single-pane or older windows can choose to install storm windows or swap them out for double- or triple-pane varieties. When comparing options, take note of the National Fenestration Rating Council (NFRC) rating, which measures their efficiency.

Installing new exterior doors can provide greater heat-trapping capabilities. Their performance is either measured by R-value or NFRC rating depending on the material (i.e., steel or fiberglass vs. glass).

4. Check Your HVAC System

Heating, ventilation, and air conditioning (HVAC) systems are responsible for regulating and moving heated and cooled air through a home or building. Replacing or cleaning filters in your HVAC system is an important part of routine maintenance to preserve efficiency and air quality, especially ahead of increased heating demand in winter.

Over time, HVAC systems with air ducts may experience leaking, especially at the seams, lowering their efficiency and raising heating costs. Forced-air heating and cooling systems lose about 20-30% of the air that moves through their ductwork due to leaks[4]. Since most duct systems are difficult to access behind walls and underneath floorboards, working with an HVAC contractor to seal HVAC ducts is recommended.

If your HVAC system is operating inefficiently or approaching the end of its useful life, replacing the old system with a cold-climate heat pump ![]() can deliver year-round comfort and long-term savings in your newly weatherized home or business. In 2022, U.S.-based sales of these efficient and emission-free dual heating and cooling systems surpassed gas furnaces by more than 400,000 units.

can deliver year-round comfort and long-term savings in your newly weatherized home or business. In 2022, U.S.-based sales of these efficient and emission-free dual heating and cooling systems surpassed gas furnaces by more than 400,000 units.

Available NYS Programs and Inflation Reduction Act Savings

NYSERDA programs and Inflation Reduction Act (IRA) tax credits can help lower the cost of weatherization for your home or business.

Depending on location and household income, New York residents can access several programs to make energy efficiency improvements for a safer, more comfortable home. Through the Comfort Home program, homeowners can access incentives between $1,000 to $4,000 for air sealing, insulation, and window upgrade packages. Meanwhile, the EmPower+ program helps low- and moderate-income families – both renters and homeowners – make home improvements that enhance comfort and reduce energy use.

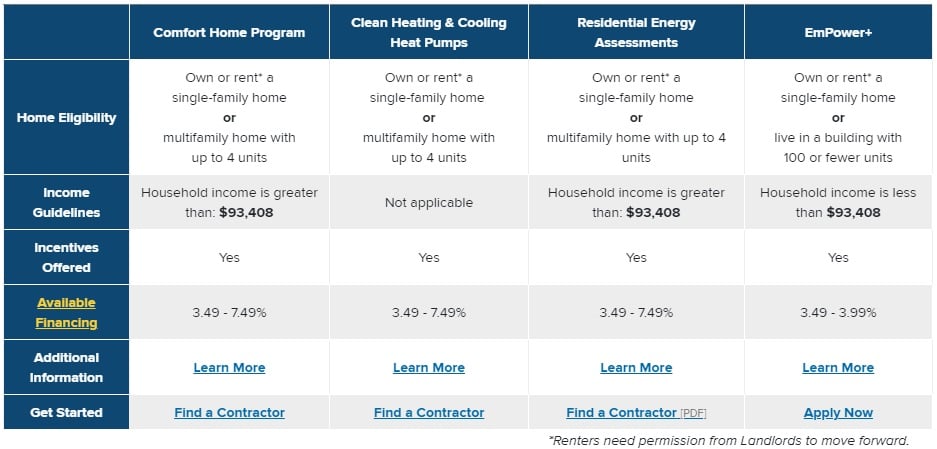

NYSERDA's Home Energy Efficiency Programs chart can help find the program that best suits your home's needs. Simply choose your county and enter the number of people living in your household to see what programs you qualify for (sample results provided in the table below).

Table shows offerings for a four-person household in Onondaga County from a November 2023 search. Show Details

- Comfort Home Program

- Home Eligibility: Own or rent* a single-family home or multifamily home with up to 4 units

- Income Guidelines: Household income is greater than: $93,408

- Incentives Offered: Yes

- Available Financing: 3.49 - 7.49%

- Clean Heating & Cooling Heat Pumps

- Home Eligibility: Own or rent* a single-family home or multifamily home with up to 4 units

- Income Guidelines: Not applicable

- Incentives Offered: Yes

- Available Financing: 3.49 - 7.49%

- Residential Energy Assessments

- Home Eligibility: Own or rent* a single-family home or multifamily home with up to 4 units

- Income Guidelines: Household income is greater than: $93,408

- Incentives Offered: Yes

- Available Financing: 3.49 - 7.49%

- EmPower+

- Home Eligibility: Own or rent* a single-family home or live in a building with 100 or fewer units

- Income Guidelines: Household income is less than: $93,408

- Incentives Offered: Yes

- Available Financing: 3.49 - 3.99%

*Renters need permission from Landlords to move forward.

Many weatherization upgrades qualify for both New York State incentives and IRA tax credits.

Home air sealing and insulation are eligible for an IRA tax credit of up to 30% of the project, capped at $1,200 per year. Windows, including skylights, qualify for a 30% tax credit, up to $600 per year. Additionally, exterior doors fetch a tax credit worth 30% of the cost, capped at $250 per door and $500 total.

Businesses and multifamily properties are also eligible for IRA tax credits for weatherization and energy efficiency improvements. The tax credit is applicable to commercial new construction and retrofit projects alike.

More on Energy Efficiency

Weatherization is an investment in comfort, safety, and long-term energy savings. Learn more about creating energy efficient and healthier living spaces with the resources and stories below.

- Energy Saving Tips: Explore ways to start improving the energy performance and comfort of your home.

- NYS Guide to Inflation Reduction Act Savings: Find out how to combine IRA tax credits and New York State incentives to save on clean energy upgrades to your home, business, or vehicle.

- Offers for Landlords or Co-ops: Learn about options for making energy efficient upgrades to a home in collaboration with a landlord, association, or co-op board.

- Regional Clean Energy Hubs: Get hands-on support navigating clean energy programs and opportunities from knowledgeable community-based organizations in your region.

Footnotes

- U.S. Energy Information Administration - EIA - independent statistics and analysis. Use of energy in homes - U.S. Energy Information Administration (EIA). (n.d.). https://www.eia.gov/energyexplained/use-of-energy/homes.php

Back to content

Back to content - Zirnhelt, H. (2022, March 11). Airtightness in buildings: Don’t let it slip through the cracks! RMI. https://rmi.org/airtightness-buildings-dont-let-slip-cracks

Back to content

Back to content - Why seal and insulate?. ENERGY STAR. (n.d.). https://www.energystar.gov/saveathome/seal_insulate/why_seal_and_insulate

. Back to content

. Back to content - Duct sealing. ENERGY STAR. (n.d.-a). https://www.energystar.gov/saveathome/heating_cooling/duct_sealing

Back to content

Back to content

Sign Up For News

Stay up to date on energy-saving programs and incentives, best practices, and more.

Stay Connected